why are reits tax efficient

Private non-traded REITs. If you invest the same amount in the two REITs you get an.

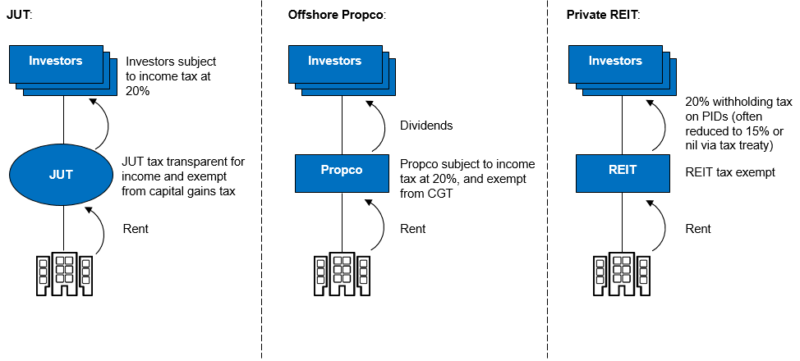

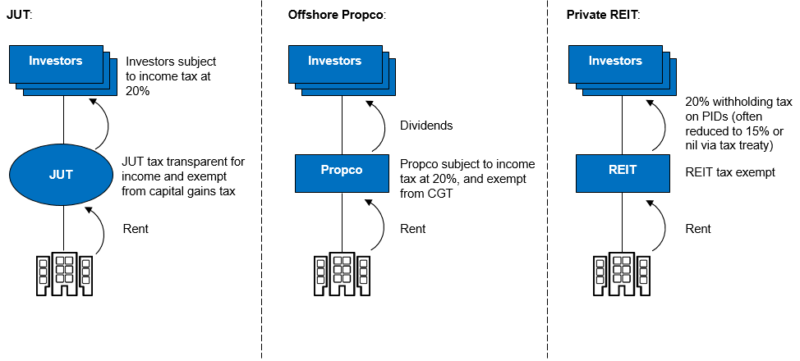

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

These three categories of REITs have subcategories too the two most common.

. REITs or Real Estate Investment Trusts have recently attracted a lot of interest from Indian investors who have a renowned obsession for real estate. Private REITs are only available to high-net-worth investors and dont trade on exchanges. Get business latest news breaking news latest updates live news top headlines latest finance news breaking business news top news of the day and more at Business Standard.

If you hold REITs inside tax-advantaged accounts like a TFSA you can sidestep the above complexity.

What S The Deal With Reits Passive Investing Australia

Daytrading Fidelity Investments Day Trading Trading Quotes Fidelity

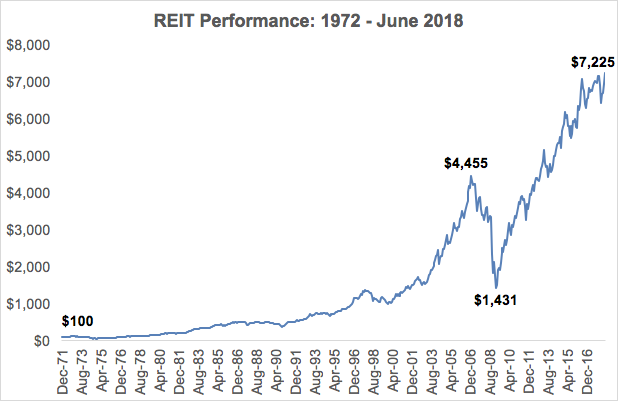

The Continuing Rise Of The Reit

Reits Vs Real Estate Mutual Funds What S The Difference

Reits Offer Retirement Income And Much More This Retirement Life Investing For Retirement Retirement Portfolio Real Estate Investment Trust

The Growing Case For Global Reits Neuberger Berman

How To Invest In Reits In The Uk Raisin Uk

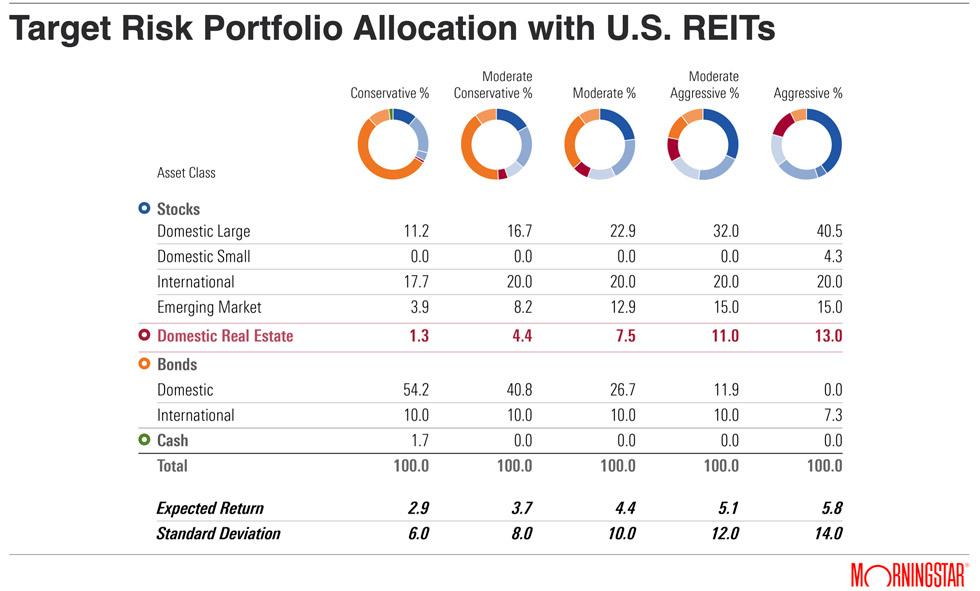

New Morningstar Analysis Shows The Optimal Allocation To Reits Nareit

Why Is There A Home Bias An Analysis Of Us Reits Geographic Concentration 1 Cairn International Edition

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

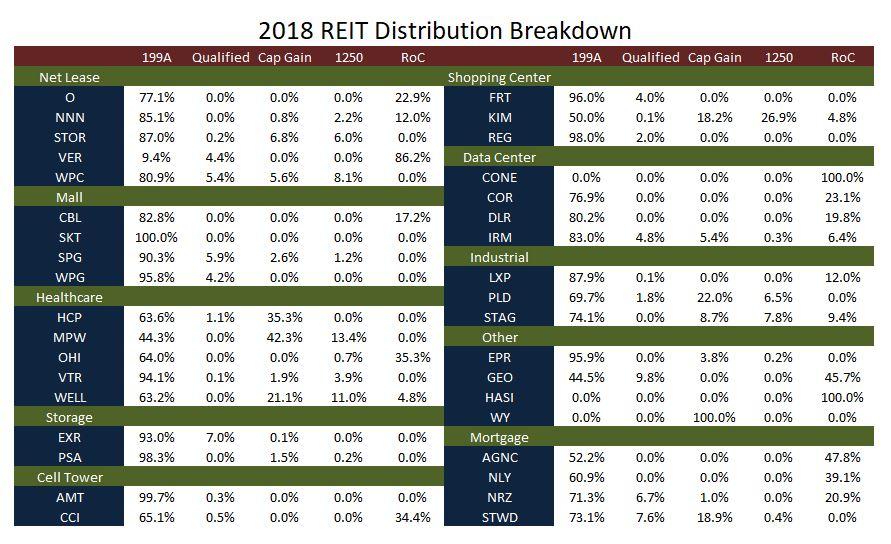

How Tax Efficient Are Your Reits Seeking Alpha

Reits Or Rental Property All Season Financial

Pin By Rcs On Investor Awareness Words Of Wisdom Words Wisdom

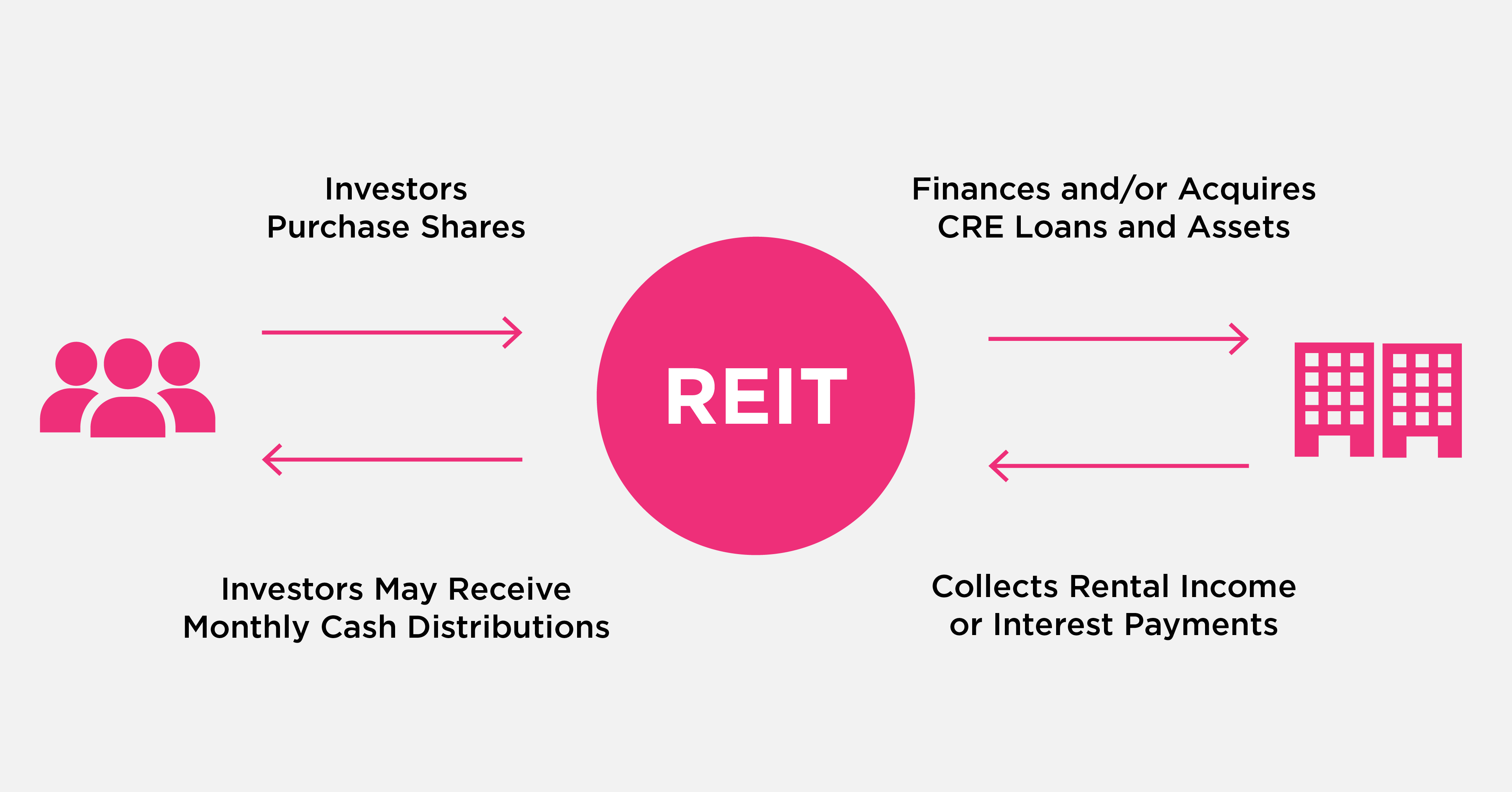

What Are Reits And How To Invest In Them Aqumon

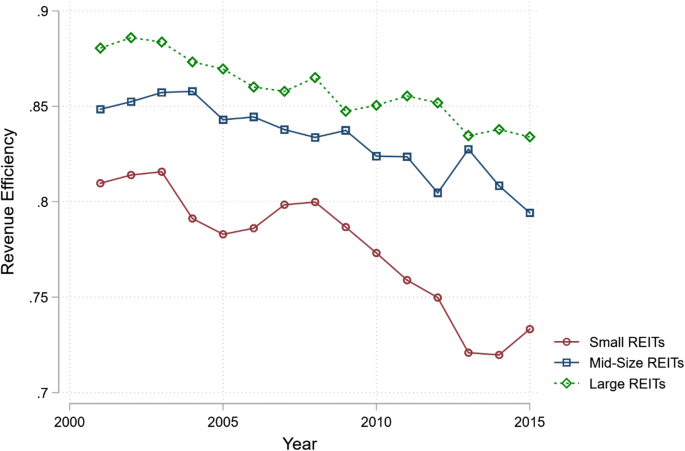

Economies Of Scale And The Operating Efficiency Of Reits A Revisit Springerlink

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties